Feie Calculator Can Be Fun For Everyone

Wiki Article

What Does Feie Calculator Mean?

Table of ContentsAll about Feie CalculatorFeie Calculator Fundamentals ExplainedSome Ideas on Feie Calculator You Need To KnowThe smart Trick of Feie Calculator That Nobody is Talking AboutSee This Report on Feie CalculatorFeie Calculator for DummiesExamine This Report on Feie Calculator

If he 'd frequently traveled, he would instead complete Component III, listing the 12-month duration he met the Physical Visibility Examination and his travel history. Action 3: Coverage Foreign Revenue (Component IV): Mark made 4,500 per month (54,000 yearly).Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percent of time he resided abroad during the tax is 100% and he gets in $59,400 as his FEIE. Mark reports complete salaries on his Kind 1040 and goes into the FEIE as an unfavorable quantity on Schedule 1, Line 8d, minimizing his taxable earnings.

Picking the FEIE when it's not the most effective choice: The FEIE might not be excellent if you have a high unearned earnings, make greater than the exemption limitation, or reside in a high-tax country where the Foreign Tax Obligation Credit History (FTC) may be much more helpful. The Foreign Tax Obligation Credit (FTC) is a tax obligation reduction technique usually used together with the FEIE.

How Feie Calculator can Save You Time, Stress, and Money.

deportees to counter their united state tax obligation financial debt with international earnings tax obligations paid on a dollar-for-dollar reduction basis. This means that in high-tax nations, the FTC can typically remove U.S. tax debt completely. The FTC has restrictions on eligible tax obligations and the maximum claim amount: Qualified tax obligations: Only income tax obligations (or taxes in lieu of revenue tax obligations) paid to international federal governments are eligible (FEIE calculator).tax obligation responsibility on your international income. If the foreign tax obligations you paid surpass this restriction, the excess foreign tax obligation can normally be carried ahead for as much as 10 years or lugged back one year (through a changed return). Preserving precise documents of foreign income and tax obligations paid is as a result vital to determining the appropriate FTC and preserving tax compliance.

expatriates to lower their tax obligation liabilities. As an example, if an U.S. taxpayer has $250,000 in foreign-earned income, they can exclude approximately $130,000 utilizing the FEIE (2025 ). The staying $120,000 may then go through taxation, yet the united state taxpayer can potentially use the Foreign Tax Debt to offset the taxes paid to the foreign nation.

The 7-Minute Rule for Feie Calculator

Initially, he offered his U.S. home to develop his intent to live abroad completely and made an application for a Mexican residency visa with his better half to assist meet the Authentic Residency Examination. In addition, Neil protected a long-lasting building lease in Mexico, with plans to ultimately purchase a residential or commercial property. "I presently have a six-month lease on a residence in Mexico that I can prolong an additional six months, with the objective to buy a home down there." Neil directs out that acquiring home abroad can be testing without very first experiencing the area."It's something that individuals need to be truly persistent about," he claims, and advises expats to be mindful of typical blunders, such as overstaying in the U.S.

Neil is careful to mindful to Anxiety tax authorities that "I'm not conducting any performing in Organization. The U.S. is one of the few nations that tax obligations its people no matter of where they live, implying that also if an expat has no income from U.S.

The smart Trick of Feie Calculator That Nobody is Talking About

tax return. "The Foreign Tax obligation Credit score allows people working in high-tax nations like the UK to offset their U.S. tax liability by the amount they have actually currently paid in tax obligations abroad," says Lewis.The prospect of reduced living costs can be tempting, yet it commonly includes trade-offs that aren't quickly evident - http://169.48.226.120/www.feiecalculator.nation.ly. Housing, for instance, can be a lot more budget friendly in some nations, yet this can mean endangering on framework, security, or accessibility to dependable energies and solutions. Economical buildings may be found in areas with irregular web, limited public transport, or undependable health care facilitiesfactors that can considerably impact your daily life

Below are a few of one of the most often asked questions about the FEIE and various other exclusions The International Earned Earnings Exemption (FEIE) permits U.S. taxpayers to leave out as much as $130,000 of foreign-earned revenue from government income tax obligation, minimizing their U.S. tax obligation obligation. To get FEIE, you must fulfill either the Physical Existence Test (330 days abroad) or the Authentic Residence Test (show your primary home in an international country for an entire tax obligation year).

The Physical Existence Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test also calls for U.S. taxpayers to have both a foreign earnings and an international tax home. A tax obligation home is specified as your prime place for company or employment, despite your family members's home. https://zenwriting.net/feiecalcu/uql44961c2.

Some Known Facts About Feie Calculator.

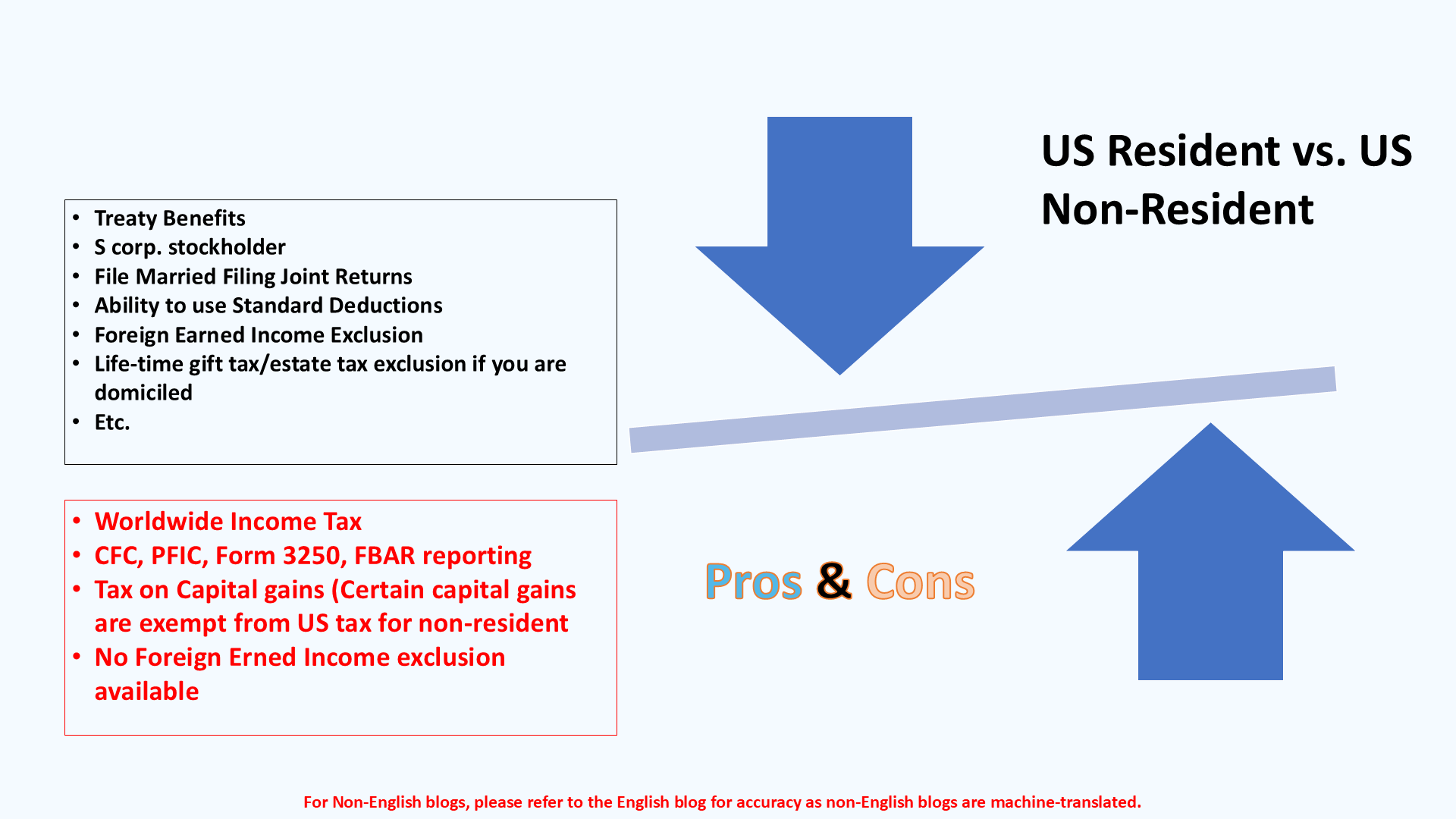

An earnings tax obligation treaty between the U.S. and another country can aid stop dual taxes. While the Foreign Earned Earnings Exemption lowers taxable revenue, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for filing for united state residents with over $10,000 in foreign financial accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the founder of The Tax obligation Man. He has more than thirty years of experience and now concentrates on CFO services, equity compensation, copyright taxation, marijuana taxes and divorce relevant tax/financial preparation issues. He is an expat based in Mexico.

The foreign earned income exemptions, often referred to as the Sec. 911 exclusions, leave out tax obligation on salaries made from functioning abroad. The exemptions make up 2 components - an earnings exclusion and a real estate see here now exclusion. The complying with FAQs review the benefit of the exclusions including when both spouses are deportees in a basic manner.

Little Known Facts About Feie Calculator.

The income exemption is now indexed for rising cost of living. The optimal yearly income exemption is $130,000 for 2025. The tax advantage omits the income from tax at lower tax obligation prices. Previously, the exclusions "came off the top" decreasing earnings topic to tax on top tax prices. The exemptions may or may not decrease earnings made use of for various other purposes, such as IRA limits, kid credits, personal exemptions, etc.These exemptions do not spare the incomes from US taxation yet just give a tax reduction. Note that a bachelor functioning abroad for all of 2025 that earned regarding $145,000 with no various other income will certainly have taxed earnings reduced to zero - successfully the same answer as being "tax complimentary." The exclusions are calculated each day.

If you attended business conferences or seminars in the United States while living abroad, income for those days can not be excluded. Your wages can be paid in the United States or abroad. Your company's place or the place where incomes are paid are not consider receiving the exemptions. Form 2555. No. For United States tax it does not matter where you keep your funds - you are taxed on your around the world income as an US individual.

Report this wiki page